The theme of the week has obviously been the rapidly falling price of solar energy.

Since late June, when I attended an energy finance powwow in Manhattan, I’ve shared with you several editorials on this topic.

We discussed how solar and natural gas are colleagues, not competitors.

We talked about how electricity from solar already costs less than from fossil fuels in some markets, and how TheStreet.com said this event — called grid parity or ‘the crossover’ — is “the most important financial event of the decade.”

We covered the record global investment in solar installations last year, which hit $91.6 billion in 2011, up from $71.2 billion the year before…

And how that would climb to over $130 billion by 2021 as solar costs continue to fall.

We also uncovered a Saudi plan to switch to low-cost solar electricity domestically so they can sell more high-priced oil abroad.

In the center of all that, there was constant discussion of the major driver of solar cost reduction — and what it will mean for shareholders…

Specifically, how one non-solar solar company has developed technologies that can further cut the cost of solar in half while doubling its power output and increasing its efficiency.

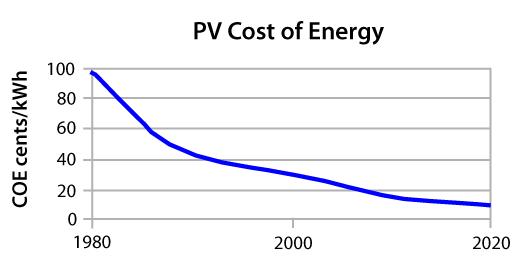

Advances like these are what’s allowing the solar cost curve to look like this… While the company’s stock chart looks like this:

While the company’s stock chart looks like this:

For comparison, that green line is Exxon.

I’ve said the capability this outfit possesses could easily make it a +1,000% winner.

And over the past couple of months, as five solar companies have signed on to test out its technology, the share price has already started to run…

If you want to learn more about how this company is a major part of “the most important financial event of the decade” — and how you can get in as its share price climbs even higher — check out this full report.

Links to all the rest of this week’s coverage below.

Call it like you see it,

![]()

Nick Hodge

Editor, Energy and Capital

Another Sector Making New Highs: Next to Energy, This is the Greatest Investment of the Century

Brian Hicks tells investors why it’s time to buy drugs.

Solar in Japan: Uncovered: Japan’s Secret Solar Plan

Solar in Japan is heating up, Jeff Siegel talks about how Japan’s quest for solar has sparked a billion-dollar investment.

Commodity Stock Booms: The Next Great Bull Markets

Analyst Ian Cooper has been on fire with his calls on commodity stocks recently. Today he shows you how to trade coal in the near term and beyond.

Natural Gas Rigs: Efficiency is Key

Editor Keith Kohl explains how drilling companies are cutting costs in half by switching to LNG-powered rigs.

The Saudis’ Secret: Investing in Solar to Sell More Oil

The cost of solar is falling every year. The cost of oil is only going up. The Saudis know this — and they’re switching to cheap solar so they can sell the rest of the world expensive oil.

Buy Housing: Homebuilders Up 23% for the Year

Publisher Brian Hicks explains why the fact that these stocks are making multi-year highs is probably the best economic story we’ve heard next to the resurgence of American oil and gas…

Corn Commodity: Stocks that Go Up When Crops Fail

Some are saying this year’s will be the poorest corn crop in 35 years. Fifty percent of the crop in the corn-rich states of Missouri, Kansas, Indiana, and Kentucky is in fair-to-poor condition.

Solar Panels Investment: Record $91.6 Billion Invested Last Year

Nick Hodge on solar panels investment: Just when I thought it was dead in the water, the solar industry is undergoing a rapid expansion.